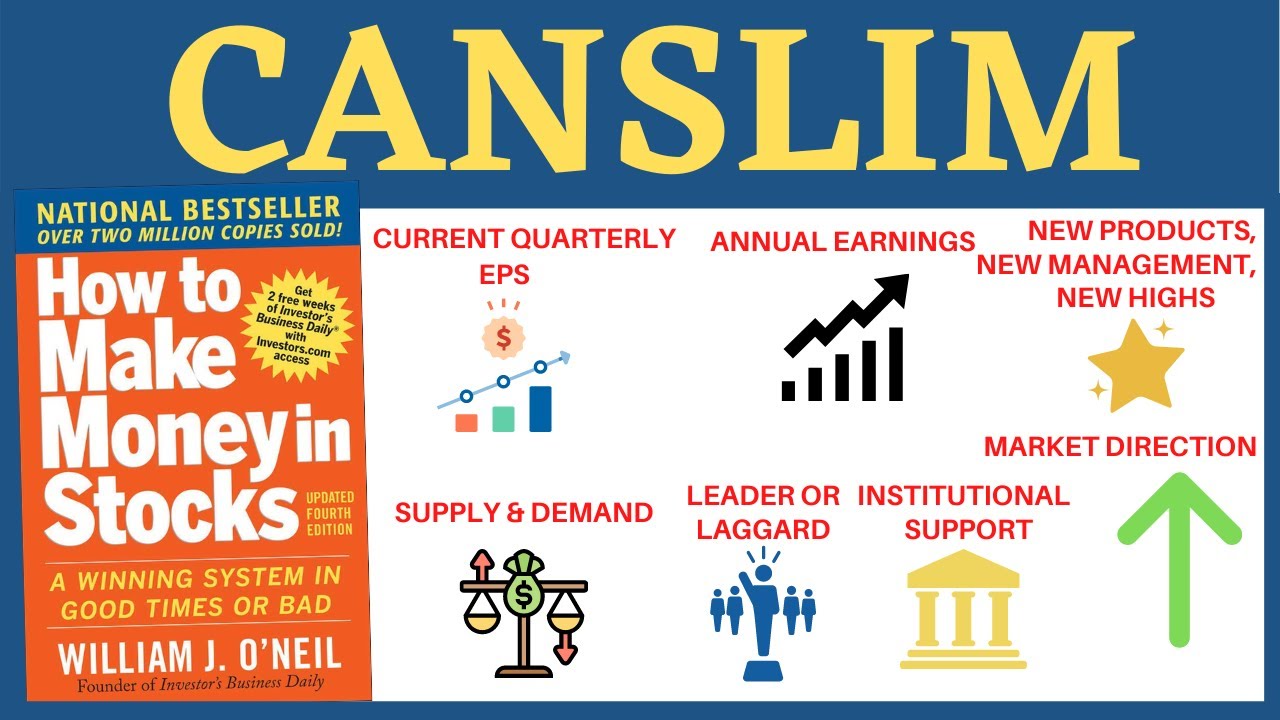

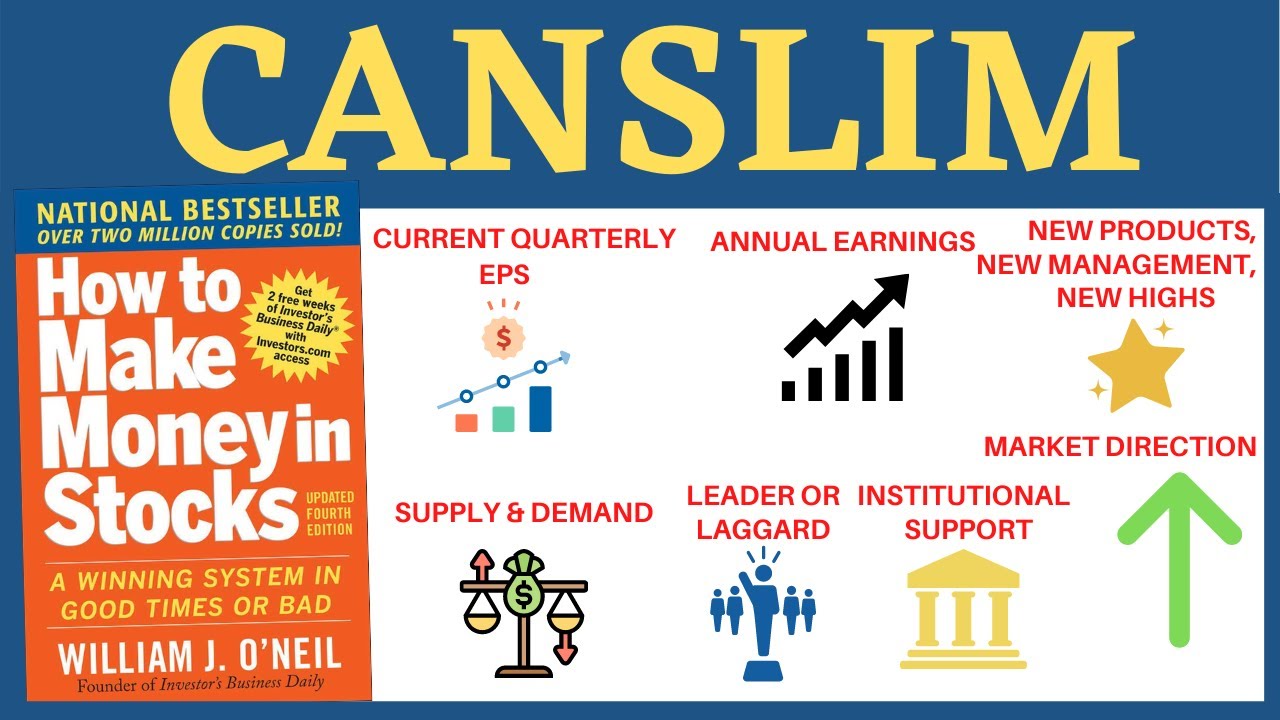

How to Pick High Growth Stocks Using the CANSLIM Method

Introduction

Hi friends! In this article, I want to discuss how to pick high-growth stocks using a method known as the CANSLIM method. This method was developed by American investor William O’Neil, who established seven parameters to identify high-growth stocks. Applying these seven parameters increases our chances of making good money in the stock market. Here, I will walk you through these seven parameters and demonstrate how to apply them practically, resulting in a selection of 10 to 11 high-growth stocks for your consideration.

The CANSLIM Acronym

The acronym CANSLIM is made up of seven characters representing the stock-picking criteria provided by William O’Neil:

C – Current Earnings

The first letter, C, stands for current earnings. According to O’Neil, a stock’s earnings per share (EPS) must have grown yearly by at least 20%. For instance, if the latest results are from Q1 2025, the EPS must show at least 20% growth compared to Q1 2024.

To apply this, we will use a free stock screener. Set the criteria for EPS growth to be greater than 25%, which is better than the minimum of 20%. Running this query, we find that 2,100 companies have met this criterion.

A – Annual Earnings

Next is the letter A, which stands for annual earnings. O’Neil advises looking at the EPS growth over a minimum of three to five years. The EPS must also show an annual growth of over 20% during this period. After applying this filter, we narrow our list down to 964 companies.

N – New Innovations

The letter N signifies something new. This means that the stock should be engaged in innovative activities, such as launching new products, making capital investments, or forming joint ventures. While this criterion is qualitative and cannot be filtered quantitatively, we will analyze stocks based on this parameter after applying the others.

S – Supply of Stock

The fourth letter, S, refers to the supply of the stock. O’Neil suggests that if the supply is limited, it can drive up the stock price. One way to identify limited supply is by checking the promoter’s holding. If promoter holding is above 65%, it indicates a lower float, leading to potential price increases. Applying this filter reduces our list to 329 stocks.

L – Leaders

Next, we have L for leaders. A stock should demonstrate high price returns over the past year compared to its competitors. We’ll only consider stocks that have outperformed the Nifty index, which has returned about 30% in the past year. After applying this criterion, we have 260 stocks remaining.

I – Institutional Investments

The letter I stands for institutional investments. O’Neil recommends selecting stocks with 5% to 15% institutional ownership. This indicates room for additional buying. By applying this filter, we find 23 stocks that meet all six criteria so far.

M – Market Conditions

Finally, M represents market conditions. O’Neil emphasizes that the CANSLIM method is effective primarily in a bull market. Currently, the Nifty 50 shows bullish trends, trading above its moving averages, indicating a favorable market environment.

We’ll also filter for stocks with a market capitalization greater than ₹5,000 crores. Running this final query, we narrow it down to 11 stocks that meet all seven criteria.

Practical Analysis of Selected Stocks

Among the selected stocks, I will choose RA T Corporation India Limited for further analysis. This stock has shown a 135% increase over the past year, rising from around ₹210 to ₹490.

Financial Performance

The company has displayed impressive financial growth, with a CAGR of 29% in revenue over the last two years and a 20% CAGR in profit after tax. Its operations span multiple sectors, including telecom services and project work.

New Initiatives

RA T Corporation is launching innovative projects, such as a train collision avoidance system and setting up edge data centers across India. These new initiatives could significantly enhance future revenue.

Valuation

In terms of valuation, RA T Corporation does not appear overvalued when compared to industry peers. Its PE and PB ratios are competitive within the engineering sector, suggesting that it is a viable investment option.

Conclusion

While the CANSLIM method provides a structured approach to identifying high-growth stocks, it has its limitations, such as not considering valuation or future earnings potential. It’s essential to conduct your own fundamental and technical analysis before investing.

I hope you found this article informative. If you learned something new, please hit the like button and leave a comment. For more insights, consider subscribing to my YouTube channel. Until next time, keep rocking in your investment journey!