Rebalancing Your Portfolio: A Comprehensive Guide

Investing in the stock market requires careful planning, consistent monitoring, and strategic adjustments. As market conditions change, so should your investment strategies. In this article, we will explore the importance of rebalancing your portfolio and how you can manage your investments more effectively. We will touch on specific stocks like Bajaj Finance, and Bajaj Finserv, and highlight top gainers today.

Why Rebalance Your Portfolio?

The stock market is always in flux. Events like global economic shifts, policy changes, or emerging market trends can affect stock prices. Recently, I have made some major changes to my portfolio due to heightened market risk. For example, I have exited my small-cap positions entirely. I had invested heavily in a small-cap index fund last year, but with the significant rise in small-cap stocks, I decided to lock in my gains and reduce exposure to riskier assets.

Small-Cap Stocks: Timing the Exit

Small-cap stocks have had an incredible run since 2020, with gains exceeding 230%. Despite this bullish trend, I believe it’s time to step back. After making approximately 90% returns on my small-cap investments, I’ve exited this segment. The market may consolidate, and holding onto these positions could pose unnecessary risks with no massive reward expected in the near future.

Shifting to Mid-Cap and Large-Cap Stocks

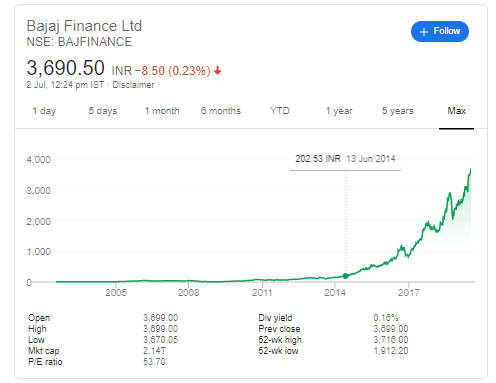

With the funds freed up from my small-cap exits, I am focusing on mid-cap and large-cap opportunities. One of the stocks I am considering is Bajaj Finance. Bajaj Finance has been a strong performer in the consumer lending space. Although the stock has seen limited movement in the past few years, the upcoming interest rate cuts could act as a catalyst for growth.

Bajaj Finance and Bajaj Finserv: A Strategic Bet

Bajaj Finance’s share price has been relatively stagnant over the last few years, but this presents a buying opportunity. As interest rates begin to decline, companies like Bajaj Finance and Bajaj Finserv could benefit significantly. Consumer lending is expected to pick up as borrowing becomes cheaper, providing a boost to both companies.

Moreover, despite competition from larger players like Jio, I believe Bajaj Finance is still a solid investment at its current level. The stock is not overpriced, and with the right market conditions, it can perform well.

Case Studies: CAMS and CDSL

Another stock I am bullish on is CAMS (Computer Age Management Services). CAMS operates in the stock market infrastructure sector and has shown strong growth in recent years. The stock has corrected by about 15% from its peak, and I see this as a dip-buying opportunity.

Similarly, CDSL (Central Depository Services Limited) operates in a similar space and benefits from a stable stock market. Companies like CAMS and CDSL are less affected by market downturns and can be good long-term investments.

Housing Finance: Aavas

Aavas Financiers, a housing finance company, is another stock worth considering. The company has been performing well, with all-time high revenues and profits. Housing finance companies tend to benefit from lower interest rates, and with the expected rate cuts in India, Aavas could see significant growth. The stock is still available at a discount, making it an attractive investment for the long term.

Avoiding High-Risk Stocks

While it’s important to identify good opportunities, it’s equally crucial to avoid stocks that may be overvalued or risky. For example, some stocks that have experienced sharp gains might be pump-and-dump schemes. These should be avoided to minimize potential losses.

Top Gainers Today: A Market Snapshot

As of today, some of the top gainers in the market include stocks from the consumer durables and IT sectors. Stocks like TCS, Voltas, and Whirlpool have been performing well due to the anticipated interest rate cuts. These companies are likely to continue benefiting from favorable market conditions.

Conclusion: Stay Informed and Strategic

Rebalancing your portfolio is an ongoing process that requires attention to market trends, economic conditions, and individual stock performance. Stocks like Bajaj Finance, Bajaj Finserv, CAMS, and Aavas Financiers are worth considering as part of a diversified investment strategy. Avoiding overvalued stocks and focusing on long-term growth opportunities will help ensure that your portfolio remains resilient in the face of market fluctuations.

Remember to stay informed, conduct thorough research, and make decisions based on fundamental analysis. The market may experience corrections, but with a well-balanced portfolio, you can navigate through these changes effectively.

I hope this article has provided you with valuable insights into portfolio rebalancing and investment opportunities. For more in-depth discussions and updates, feel free to join our investment community.