Understanding Growth Opportunities in the Auto Sector: A Focus on Tyre Stocks

Friends, whether you’re driving a car, truck, or any vehicle, tyres are a vital product needed by all. Welcome back to Stock for Retail, where we explore key stock market insights. Today, we will discuss the auto sector and the growth potential of the tyre industry, especially in light of the electric vehicle (EV) revolution. This sector offers significant opportunities, and focusing on tyre manufacturing companies could be a smart move for investors.

Nifty 50 and Market Overview

Before diving into specific tyre stocks, let’s take a quick look at the broader market situation, particularly Nifty 50. Currently, Nifty is trading slightly away from its 9-day moving average, and we could see a bit of selling pressure in the coming days. However, remember that in the long term, the stock market tends to perform higher highs and higher lows. Keeping this in mind, let’s focus on some leading tyre manufacturers and their growth potential.

MRF: A Giant in the Tyre Industry

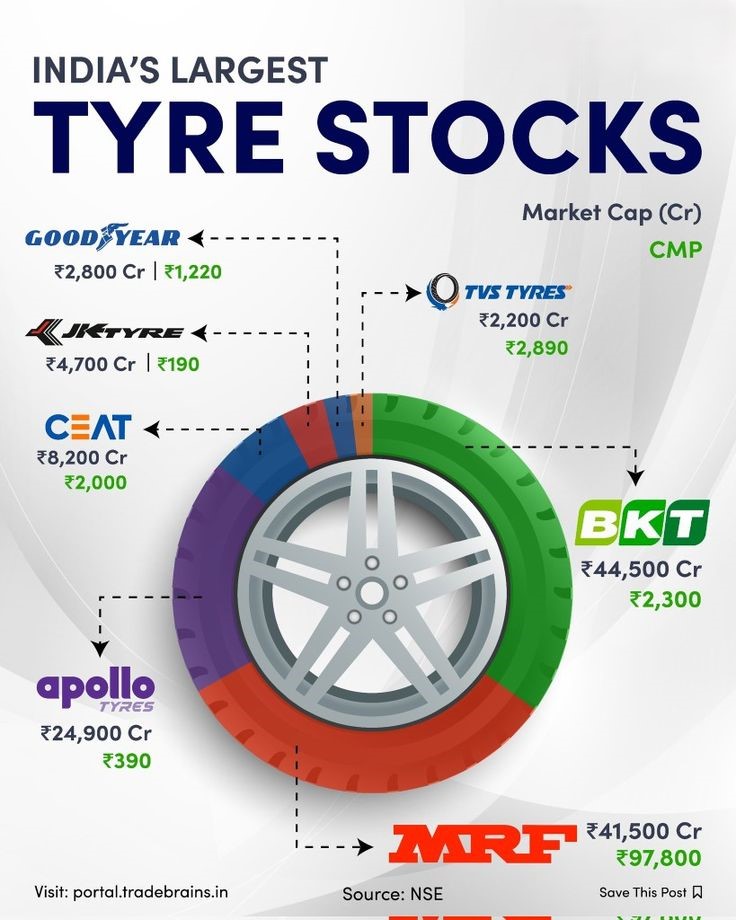

When we talk about MRF, one of the most well-known and expensive stocks in the Indian stock market, it’s essential to understand that the high price (currently around ₹141,000) doesn’t necessarily mean it’s overvalued. Valuation matters more than price. MRF has given a 3% return in the last month and about 5% in the last six months. Over time, MRF has shown significant returns, with all-time returns around 7300%.

Despite its high stock price, MRF has never issued stock splits or bonus shares, making it unique. The company manufactures tyres for a wide range of vehicles, including cars, SUVs, vans, bikes, scooters, trucks, and buses. While the stock has strong fundamentals, this isn’t a recommendation to invest blindly; always research before making decisions.

Apollo Tyres: A Consistent Performer

Moving on to Apollo Tyres Ltd., another key player in the tyre sector. Apollo has been consistently paying dividends and maintaining a positive cash flow. The company’s fundamentals are solid, with a strong return on equity and return on capital employed (ROCE). While the company carries a debt of ₹4,900 crores, the debt-to-equity ratio remains manageable.

Apollo Tyres is trading at an undervalued price, according to its price-to-earnings (P/E) ratio and PEG ratio. With a face value of 1, there’s no scope for a stock split anytime soon, but the stock is currently priced around ₹480. For long-term investors, Apollo Tyres offers a good balance of profitability and potential growth.

Balkrishna Industries: A Leader in Off-Highway Tyres

Balkrishna Industries specializes in off-road tyres and is a leading exporter of off-highway tyres, including agricultural and industrial tyres. The company is profitable, consistently paying dividends, and has positive cash flow. However, it appears slightly overvalued according to its Graham number, but the return on equity (ROE) and ROCE are excellent.

This stock, currently priced around ₹1,500, has seen some recent declines from its highs. But historically, whenever the stock has hit downtrends, there has been a solid reversal. Investors should keep an eye on the technical patterns and look for opportunities to enter at favourable prices.

Good Year India: Small Cap with Big Potential

Good Year India is another strong player in the tyre market, consistently providing dividends and maintaining profitability. Despite having a negative cash flow, the company shows promise for long-term investors. Its price-to-earnings ratio suggests that the stock might be slightly overvalued, but with a face value of 10, there’s potential for a stock split in the future.

Currently priced around ₹1,162, Good Year India falls into the small-cap or even micro-cap category. This presents an opportunity for growth, especially considering the company’s potential to transition into a mid-cap or large-cap stock over time.

JK Tyre: A Leader in Truck and Bus Tyres

JK Tyre is another notable player, deriving about 54% of its revenue from truck and bus tyres, and 30% from passenger and line radial tyres. The company is a leader in the radial tyre segment and supplies many well-known automotive manufacturers.

The company consistently pays dividends and remains profitable, although the cash flow is negative. JK Tyre is trading at an undervalued price based on its P/E ratio and PEG ratio. However, its debt-to-equity ratio is slightly higher than ideal, at over 1, making it a riskier option compared to others. Yet, the stock’s long-term growth potential makes it worth considering for investors willing to take on some risk.

Conclusion: The Future of Tyre Stocks

The tyre industry holds significant growth potential, especially with the expected boom in the auto sector, driven by the EV revolution. While each company mentioned has its strengths and weaknesses, all show long-term potential for growth. Remember, fundamentally strong stocks often yield the best returns, and keeping an eye on technicals and valuations can help you make informed decisions.

If you’re interested in learning more about the stock market and how to become a confident investor, we’ve launched a course based on Triple D that covers everything from market basics to advanced strategies. Check the description for more details!

And as always, this is not investment advice—we share information to help you learn and grow as an investor. Make sure to like, comment, and share this blog post with your friends!